Since the inception of Climate Action 100+, investor signatories have asked companies to take action to reduce greenhouse gas (GHG) emissions across their value chains. In accordance with the latest climate science, this implies the need to move towards net zero emissions by 2050 or sooner, with interim GHG reduction targets over the short-, medium-, and long-term.

Once these targets are set, companies need to demonstrate how they will reach them via a decarbonisation strategy. A prerequisite for a robust decarbonisation strategy is for the company to have both long- term (2036-2050) and medium-term (2026-2035) GHG reduction targets.[1]

But for a decarbonisation strategy to be meaningful, it cannot just describe what the company plans to do – like switch to renewable energy or produce low carbon products – it must articulate how each part of the plan will contribute to the company achieving its targets.

Grappling with the “how” and quantifying each action is no small feat. A company’s decarbonisation plan needs to address its largest and most material emissions sources. Investors want to see credible, robust decarbonisation strategies that give them confidence that the company’s GHG reduction targets will be met.

“Even in the context of increasingly challenging world events, it is essential we stay focused on delivering long-term climate goals. Setting emissions reduction targets is an important first step for corporate emitters. But it is critical that companies then articulate how they will deliver these via a robust decarbonisation strategy. This is critical to enabling investors to assess how companies are aligning with a 1.5°c pathway.” Stephanie Maier, global head of sustainable and impact investment at gam investments and a member of the global climate action 100+ steering committee.

Net zero company benchmark indicator 5 – assessing decarbonisation strategy

Indicator 5 of the Disclosure Framework in the Climate Action 100+ Net Zero Company Benchmark (“the Benchmark”) assesses the key elements that should comprise any company decarbonisation strategy and is focused on target delivery. It currently has two sub-indicators:

- Sub-indicator 5.1 asks a company to disclose the strategy to meet its long- and medium-term GHG reduction targets. This blog will focus on Sub-indicator 5.1, as it is applicable to all companies. (Note: Indicator 5 does not currently require a short-term target given that the Benchmark’s definition of short-term is only through 2025.)

- Sub-indicator 5.2, which asks companies to specify the role of ‘green revenues’ in their strategy. This is currently only assessed for companies headquartered in the European Economic Area (EEA) or the United Kingdom (UK).

What does sub indicator 5.1 ask of focus companies?

Metric 5.1.a: “The company identifies the set of actions it intends to take to achieve its GHG reduction targets over the targeted timeframe. These measures clearly refer to the main sources of its GHG emissions, including Scope 3 emissions where applicable.”

Metric 5.1.b: “The company quantifies key elements of this strategy with respect to the major sources of its emissions, including Scope 3 emissions where applicable (e.g. changing technology or product mix, supply chain measures, R&D spending).”

The underlying metrics for Sub-indicator 5.1 illustrate that companies should not only describe how their transition will be driven by use of various emissions-reducing activities and low-carbon technologies (Metric 5.1.a), but also demonstrate an understanding of what percentage each technology contributes to the company’s total projected GHG reduction goals and a net zero future (Metric 5.1.b). Notably, according to the Benchmark public methodology guidance for these metrics, the role of offsets in reaching GHG reduction targets should also be specified.[2]

Following the first round of company Benchmark assessments in March 2021, feedback indicated that Climate Action 100+ could strengthen Indicator 5 by clarifying the methodology language. The description in the original methodology had not sufficiently captured the requirement that companies needed to quantify the approximate contribution of each action to their overall greenhouse gas reduction target.

To that end, further guidance for meeting Metric 5.1.b was added to the Benchmark public methodology guidance announced by the initiative in October 2021. Downgrades in scores between March 2021 and March 2022 were therefore anticipated and did indeed occur for 15 companies. However, as was the goal with this update, the March 2022 assessments better reflect robust decarbonisation plans that meet investor expectations.

Describing but not quantifying – benchmark company performance in march 2022

In the March 2022 Benchmark assessments, 64% (106) focus companies were reviewed, as the remaining companies didn’t have both long- and medium-term GHG reduction targets (a prerequisite for being assessed on Indicator 5). Over a third (36%) of companies therefore received an automatic “No” on Sub-indicator 5.1, because those companies can’t deliver on targets that don’t exist.

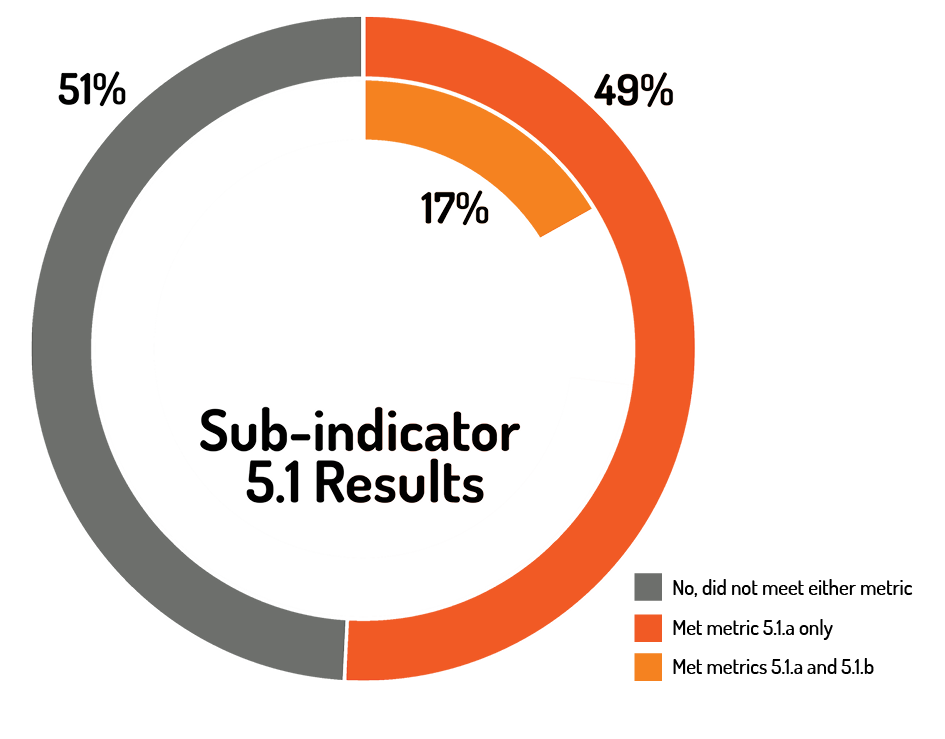

While nearly half (49%) of focus companies scored “Yes” or “Partial” on Sub-indicator 5.1 and have identified the set of actions they intend to take to achieve their GHG reduction targets (Metric 5.1.a), only 17% state the quantitative contribution of each measure to their overall emissions reduction target (Metric 5.1.b).

Overall takeaway: Companies that had set targets were often describing their planned decarbonisation actions but not quantifying them.

While the Benchmark is sector-agnostic, analysis of the March 2022 assessments found that some sectors performed better than others on Sub-indicator 5.1, but that there were common challenges and areas for improvement across sectors. For more details, please see Sector Insights – March 2022 Benchmark Assessments. For more information about what a credible decarbonisation plan entails by sector, please see the Climate Action 100+ Global Sector Strategies.

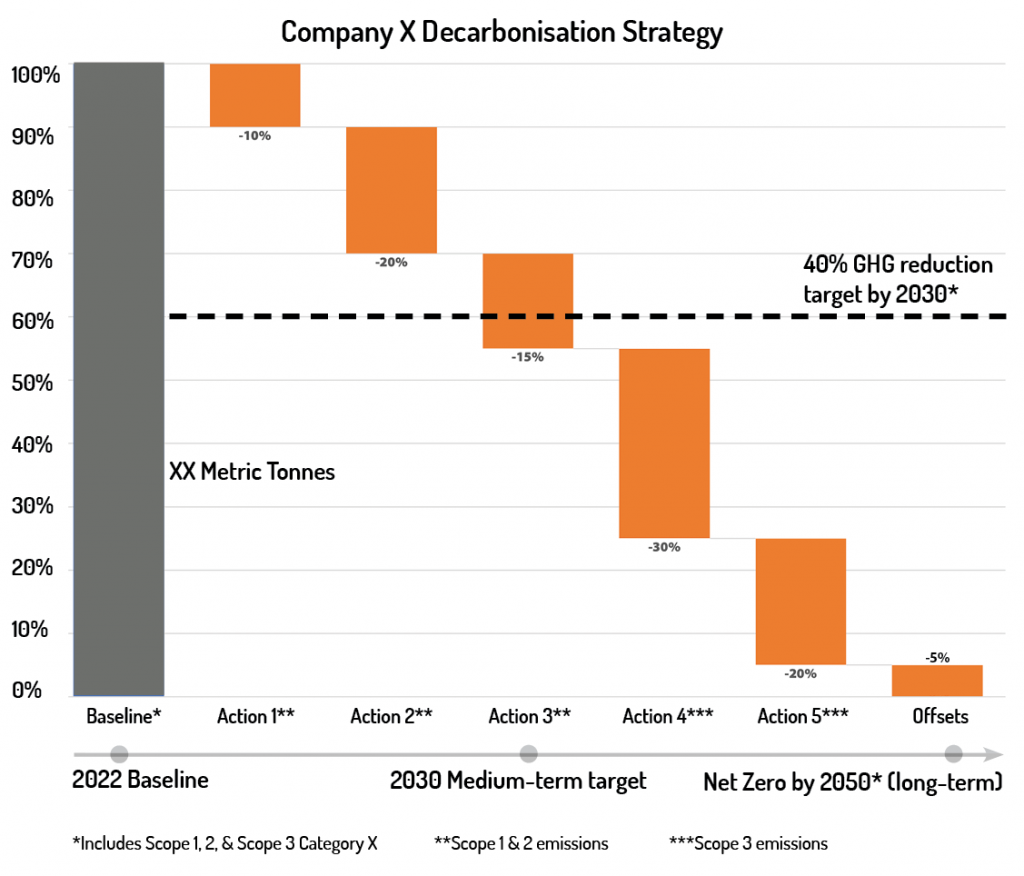

Spotlight: what does quantification look like in a corporate disclosure

Quantification could include a numeric breakdown of what share of the overall emissions reductions the company plans to achieve through different elements of the decarbonisation strategy, and to which emissions scopes these apply. Alternatively, the company could share what changes in the energy, product, or revenue mix are to be achieved at various points during the targeted time frame.

The following sample graph shows a skeleton of how each of these types of quantification might appear in a corporate disclosure.

Disclaimer: Note that adopting company disclosure according to the example above does not guarantee receiving a “Yes” score on Metric 5.1.a or 5.1.b.

Please refer to the Disclosure Framework Assessment Methodology for more details.

A quick word on offsets

Use of offsets in corporate decarbonisation strategies poses a challenge, given concerns pertaining to overreliance on offsets, in addition to offset quality and integrity. The use of offsetting or carbon credits should be avoided and limited, if applied at all.

Companies are encouraged to be transparent about how they use offsets, and to clearly delineate between their own emission reduction efforts and the emission reductions delivered through offsets. This transparency also allows Climate Action 100+ to revisit company assessments as the collective thinking on offsets evolves.

Offsets are explicitly referred to in the methodology guidance for Sub-indicator 5.1, which asks that any decarbonisation strategy “clearly identifies the set of actions the company will implement to achieve its decarbonisation targets (such as phasing out carbon-intensive products or assets, developing or deploying low-carbon technologies, decarbonising supply chains or using offsets).” Whilst disclosing the contribution of offsets is currently not mandatory to score on these Metrics, offsets will be an area for future development in the Benchmark. For more details, see the Benchmark FAQs.

No time to lose

Investors welcome enhanced decarbonisation strategies and disclosures that describe and quantify how a company will address its largest emissions sources in order to reach its GHG reduction targets over all time frames. These are tough questions a company must grapple with, to be sure. But, as climate science tells us, there’s no time to lose.

[1] In order to score on Indicator 5 of the Disclosure Framework in the Climate Action 100+ Net Zero Company Benchmark, per the current methodology, companies need to have both long- and medium-term GHG reduction targets. Although a short-term target is not currently a prerequisite for scoring on this indicator, best practice would include a short-term target as well.

[2] It is not currently necessary to specify the role of offsets to score on Indicator 5, however this is under discussion for the next iteration of the Benchmark